General Fund

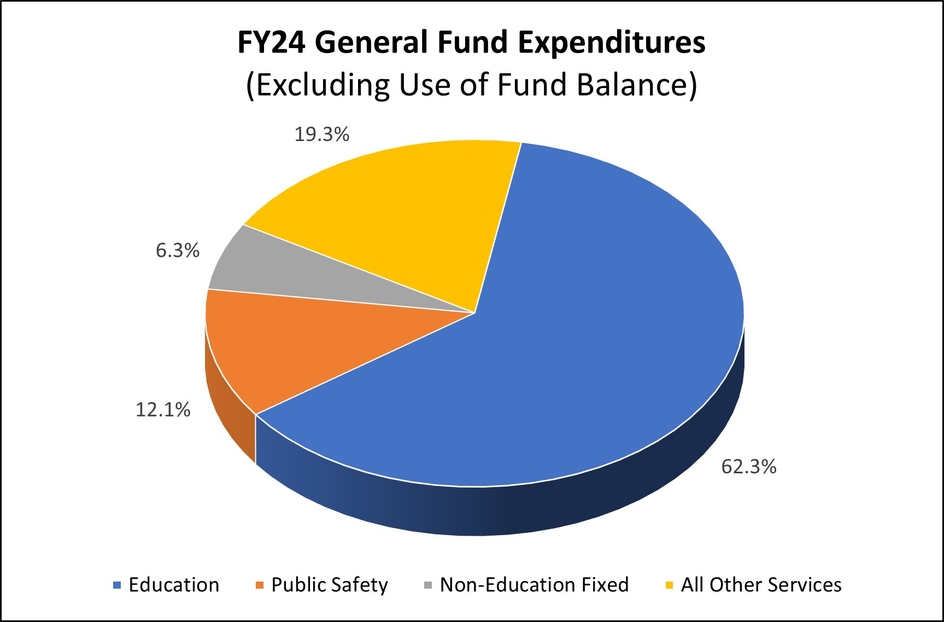

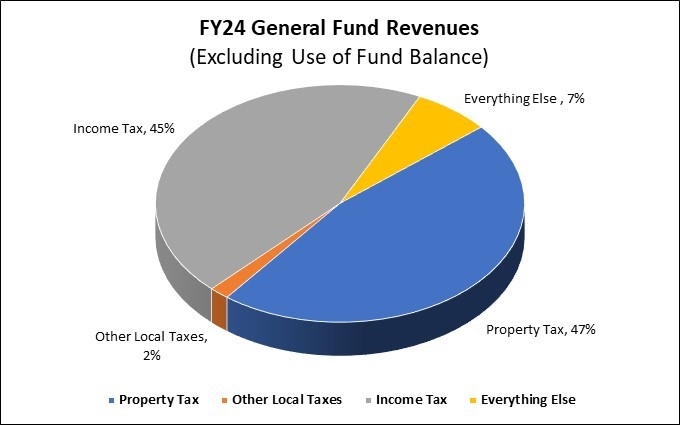

The General Fund is the largest fund for Howard County Government and is used to account for services which are not legally required to be accounted for in a special fund or in an enterprise fund as self-supporting operations. The fund includes general tax revenues, such as property and income taxes, and general expenditures such as the county’s cost of education and public safety.

The General Fund budget for Fiscal Year 2024 is $1.5 billion.

How Does the General Fund Work?

General Fund Revenues

Property and income taxes account for over 90% of total ongoing revenues (excluding use of fund balance)

- There are over 100 revenue sources that support the General Fund such as different types of taxes, licenses and permit fees and charges for using different county facilities.

- Over 90% of total recurring revenues come from two sources - property taxes paid by County residential and commercial property owners and income taxes paid by County residents.

General Fund Revenue Trend

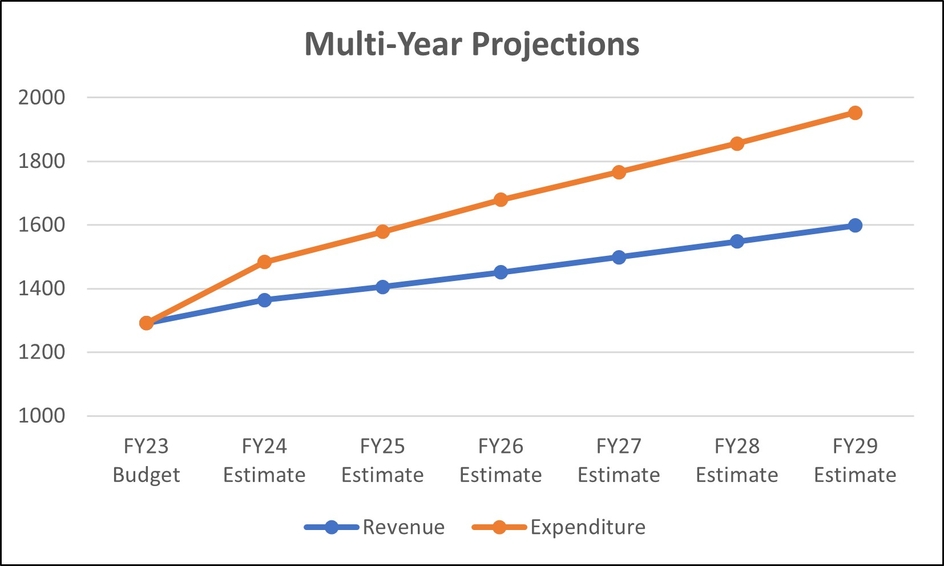

The Fiscal 2024 Spending Affordability Advisory Committee (SAAC) report states that “the County remains in the midst of a transition from historically rapid population and personal income growth to a new norm of slower growth.”

-

Revenue growth has been slowing from an annual average of about 7.5% in the first decade of the 2000’s to about 3.5% in the last decade preceding the COVID pandemic.

-

During the pandemic, revenues experienced a surprising spike, driven by temporary factors such as the sizable federal stimulus, strong performance in the stock and real estate markets, and inflation which stimulated wage growth.

-

As the temporary pandemic driven revenue increases diminish, revenue growth is expected to return to the pre-pandemic levels experienced in the second decade of the 2000’s.