Reinvest*Renovate*Restore (RRR) Program

Rehabilitation Loan Fund Program

The RRR Home Rehabilitation Loan Fund Program is intended to assist income eligible Howard County homeowners with making necessary repairs and can improve overall neighborhood appearance in some cases. Eligible repairs can assist homeowners with meeting local housing code to improve the health and safety conditions of their homes or to address outstanding maintenance. In some cases, the loan can help to rehabilitate the home cosmetically as well and encourage residents to stay in their homes. Repairs may include but are not limited to: heating and air conditioning systems, electrical improvements, plumbing, roof replacements, installation of windows and doors, painting and even landscaping.

NOTE: If you own your home and are facing foreclosure click here to review our Foreclosure Prevention Program and see if you quality.

Accessibility needs?

This program can also be utilized to cover the cost of necessary improvements that would assist with mobility, hearing, vision, or other special needs throughout the home, making it a safe and comfortable environment for you or your loved ones. Exterior ramps, chair lifts, height adjustments, and grab bars are just some of the modifications that can be made through the program for eligible households.

Who is eligible?

Must own a single family home, townhome, condo, or mobile home in Howard County.

Occupy the home full time as the principal residence.

Have owned the property for at least one year.

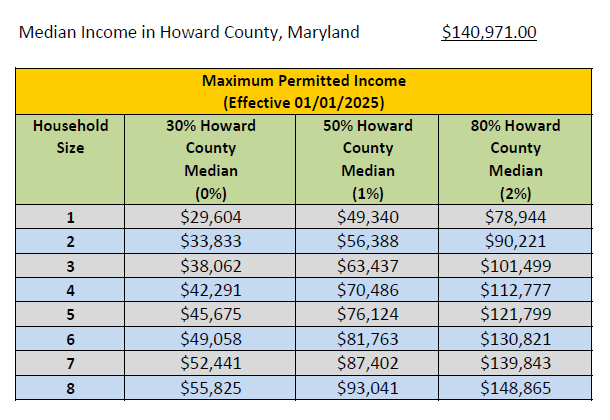

Household gross annual income does not exceed 80% of Howard County’s average median income (AMI; see chart for details).

Debt to income ratio (DTI) does not exceed 45%.

All dues such as mortgage, property taxes, homeowners’ insurance, and HOA/Condo fees must be current and up to date.

Credit score of at least 620.

Loan to value (LTV) of the home cannot exceed 110%.

Income Limits - See below or click here for the maximum income limits for your family.

Loan Terms:

The maximum loan offered is $50,000. All loans are evidenced by a Promissory Note and secured by the real estate through a Deed of Trust recorded in the County’s Land Records. The term of the loan shall be determined by the homeowner’s ability to repay the loan. Interest rate will not exceed 2%. Maximum loan term: 5 or up to 30 years.

Loan Tiers - Loan tiers determine the type of loan an applicant may be approved for, and the tier is based on each household’s gross monthly income.

- Tier 1: 30% AMI, 0% fixed interest rate. Repayment is not required for this type of loan. The total balance of this loan is reduced by 20% each year of its 5 year term.

- Tier 2: 50% AMI, 1% fixed interest rate. Repayment is not required for this type of loan. The balance is the loan is deferred. Re-payment is due up the sale or transfer of the subject property.

- Tier 3: 80% AMI, 2% fixed interest rate. Repayment is required for this type of loan. Payments are made on an amortized schedule in equal monthly payments with a loan term of up to 30 years. Payments are calculated based on the applicant’s ability to repay the loan.

Application Process:

Submit fully completed application packet with proof of income via email, certified mail, or in-person. Applications will not be considered if they are submitted without proof of income attached. You then will be contacted in writing to confirm receipt of the application by the Loan Coordinator. Applications are processed, including a soft credit pull via all three credit bureaus. If you are pre-approved, you will be asked to provide further information including but not limited to: proof of homeownership, tax filing status, assets, insurance, any other clarifying documents, etc. Then, the application with all supporting documents will be sent to Loan Review Committee for final approval. Please note that the application process may take up to 8 weeks.

Documents:

Application for the RRR Home Rehabilitation Loan Program - click here to download

Program Description and Income Limits - click here to download *updated January 2024*

Please call 410-313-6333, Monday - Friday from 8:30 a.m. to 5:00 p.m. with questions or concerns.

DISCLAIMER: The RRR program guidelines are subject to change. Applicants who fall under Tier 3 must begin their loan payments on the first day of the month following loan closure. This loan is not intended to assist with renovations for re-sale. There is a 20% penalty plus remaining principal that is due immediately if the home is sold or foreclosed, or if the loan recipient no longer resides at the subject property as their primary residence within 5 years of loan disbursement. This loan is not intended for use to re-pay existing construction work or to re-pay any type of outside loans. Funds must be used for new construction work through the RRR program only. This loan is not intended for use on projects meant to make routine maintenance or cosmetic improvements only. All funding must be used to repair major systems first..

OTHER RESOURCES FOR HOUSING REPAIRS AND WEATHERIZATION

The Howard County Housing Department also administers the Maryland Housing Rehabilitation Program (MHRP) and the Maryland Whole Home program to County homeowners on behalf of the Maryland Department of Housing and Community Development..

The programs listed below offer grants and/or loans that could assist with repairs and weatherization as well. Each have their own criteria and must be applied for separately. Please contact them at the links below for more information: