General Fund

The General Fund is the largest fund for Howard County Government and is used to account for services which are not legally required to be accounted for in a special fund or in an enterprise fund as self-supporting operations. The fund includes general tax revenues, such as property and income taxes, and general expenditures such as the county’s cost of education and public safety.

The General Fund budget for Fiscal Year 2024 is $1.5 billion.

How Does the General Fund Work?

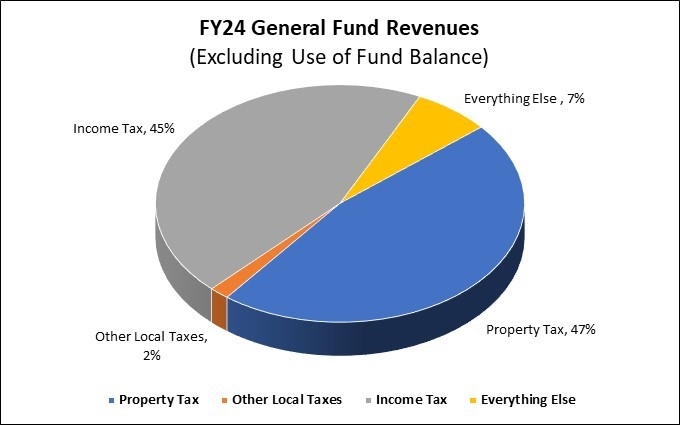

General Fund Revenues

Property and income taxes account for over 90% of total ongoing revenues (excluding use of fund balance)

- There are over 100 revenue sources that support the General Fund such as different types of taxes, licenses and permit fees and charges for using different county facilities.

- Over 90% of total recurring revenues come from two sources - property taxes paid by County residential and commercial property owners and income taxes paid by County residents.

General Fund Revenue Trend

The Fiscal 2024 Spending Affordability Advisory Committee (SAAC) report states that “the County remains in the midst of a transition from historically rapid population and personal income growth to a new norm of slower growth.”

-

Revenue growth has been slowing from an annual average of about 7.5% in the first decade of the 2000’s to about 3.5% in the last decade preceding the COVID pandemic.

-

During the pandemic, revenues experienced a surprising spike, driven by temporary factors such as the sizable federal stimulus, strong performance in the stock and real estate markets, and inflation which stimulated wage growth.

-

As the temporary pandemic driven revenue increases diminish, revenue growth is expected to return to the pre-pandemic levels experienced in the second decade of the 2000’s.

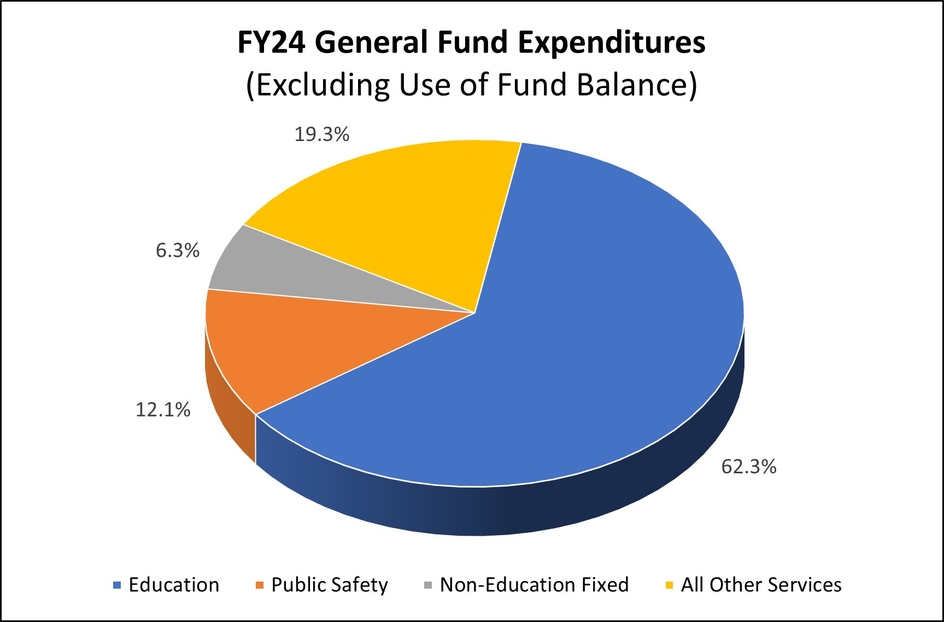

General Fund Expenditures

Education (Public Schools, Library, Community College) remains the County’s top priority.

-

County funding to education accounts for almost 2/3 of the total budget (excluding use of fund balance), with funding for the public schools exceeding half of all General Fund spending.

-

County funding to education is over five times the funding for public safety, the second largest area of county spending.

- Howard County is listed in the top 10 per pupil spending school districts among the 1,000 largest school districts in the nation.

Top 10 Per Pupil Spending in the United States

Source: Census Bureau, "Per Pupil Amounts for Current Spending of the 1000 Largest Public Elementary-Secondary School Systems in the United States by Enrollment: Fiscal Year 2020"

| Rank | School System | State | Dollars Per Pupil |

|---|---|---|---|

|

1 |

New York City | New York | $28,828 |

| 2 | Boston | Massachusetts | $27,793 |

| 3 | Washington Schools | District of Columbia | $22,856 |

| 4 | Atlanta | Georgia | $17,289 |

| 5 | Seattle | Washington | $17,250 |

| 6 | San Francisco Unified | California | $17,139 |

| 7 | Chicago | Illinois | $17,041 |

| 8 | Montgomery County | Maryland | $16,697 |

| 9 | Columbus | Ohio | $16,656 |

| 10 | Howard County | Maryland | $16,615 |

Key General Fund Spending Drivers

Spending drivers include not only rising demands for priority services, such as education, but also rising costs of providing same level of services. Same service costs increase continuously due to employee pay/benefits and long-term liabilities (e.g., debt payments for infrastructure projects, pension, retiree health benefits, etc.).

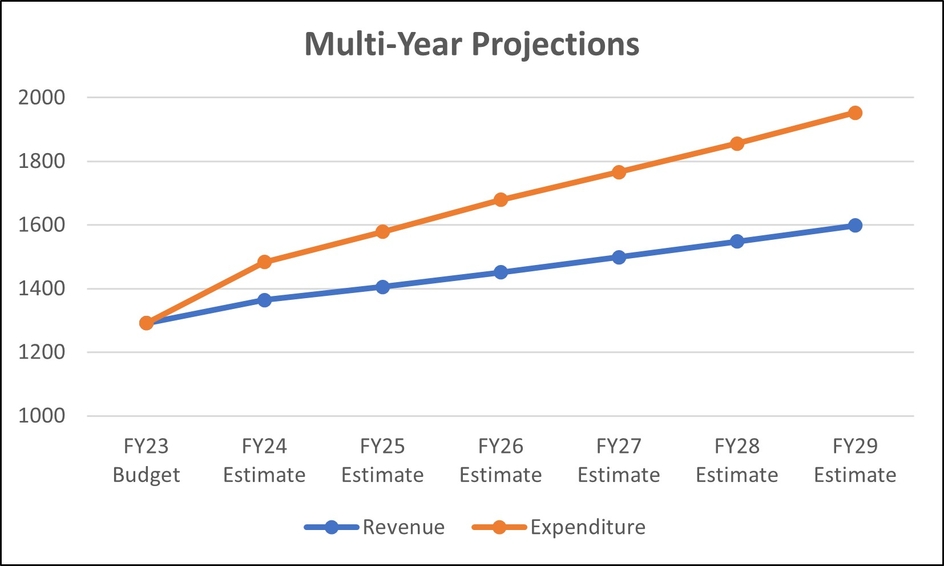

General Fund Long-Term Outlook

The Fiscal 2024 Spending Affordability Advisory Committee (SAAC) report states that without corrective action, the county’s annual revenue to spending deficit is “predicted to increase from $120 million in FY 2024 to $355 million in FY 2029.”

The structural gap is attributable to:

- Expenditure growth (driven by service costs and rising service needs) outpacing revenue growth.

-

Slowdown in population growth due to diminishing developable land and less new development, which adversely impacts growth in the county’s primary revenue sources – property and income taxes.

The County is required by law to balance its annual budget and close any funding gaps. Additional revenue options are limited in the current environment given the already high tax burden in the County, as well as the large number of residents and businesses still in the process of recovery from the pandemic’s impact. Both the County and educational institutions have to focus on the prioritization of need and the development of sustainable long-term plans based on fiscal realty.